Canadians are familiar with the concept of joint ownership with right of survivorship. It is the prevalent form of ownership between spouses. Therefore, it is not uncommon for Canadians to own U.S. real property or other U.S. property, jointly, especially between spouses. Many are of the view that it will…

Category: Joint Tenancy

This blog post was written by Alicia Mossington, Estate and Trust Consultant, Scotiatrust London Executors in Ontario are often required to obtain a Certificate of Appointment of Estate Trustee (colloquially and historically referred to as “probate”). Although Estate Administration Tax (“probate tax”) is applicable across many jurisdictions in Canada, it…

The benefits of joint property ownership as an estate and probate planning strategy are well known; property vests to the surviving owner(s) on death thus, bypassing the estate and avoiding probate fees. In the right circumstances, joint ownership works great and facilitates the succession of the property. However, what may…

Pictured: My beloved dog, Yuki, in her Christmas tree outfit. When thinking about what to write for this week’s blog post, I realized that I have the last Fasken slot before Christmas. This got me thinking: what can I write that’s relevant to the holidays? It then dawned on me…

In the estates context, undue influence is often alleged in order to challenge a will or an inter vivos transfer of property, often a family home or cottage. When a party in a legal dispute alleges that there was undue influence which party bears the burden of proving (or disproving)…

Andrew Coates, Associate, Gowling WLG (Canada) LLP Today was supposed to be the due date for untold numbers of T3 returns and Schedule 15s for trusts known as “bare” trusts in existence on December 30, 2023. Not only was it going to be the first year that the Canada Revenue…

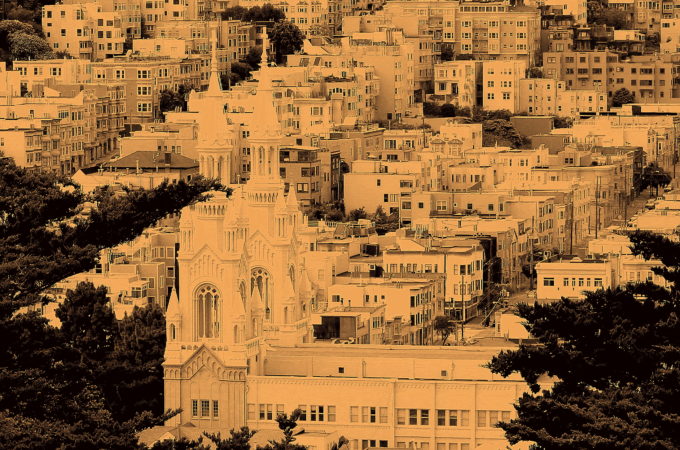

Trustees holding title to real property jointly with right of survivorship should make estate succession efficient and inexpensive. But recent changes implemented by the Director of Land Titles are challenging that notion.

This blog has been written by Mohena Singh, Associate at Fasken LLP As an estate planner, one of the most common questions I am asked is, “How do I transfer my house or cottage to my family without paying estate administration tax?” A common way we have seen individuals attempt…

The Ontario Court of Appeal (“ONCA”) decision in Gefen Estate v. Gefen is an interesting read which provides insight into a variety of topics including mutual wills and mutual will agreements, secret trusts, the doctrine of unconscionable procurement, and more! By way of background, Elias and Henia Gefen were married…

While the right of survivorship is often thought of as the defining characteristic of joint tenancy, joint tenancy is also defined by “four unities.” Justice Perell succinctly defined the “four unities” in Royal & SunAlliance Insurance Company v Muir, 2011 ONSC 2273: A joint tenancy is distinguished by what are…