Today’s blog was written by Jessica Butler, Law Clerk at Fasken LLP. Many Canadians hold a large share of their wealth in personally-owned real estate and consider it to be a critical part of their wealth-building strategy. Donald Sutherland, the well known Canadian actor who passed away in June of…

Category: Property

Today’s blog was written by Courtney Lanthier, Law Clerk at Fasken LLP With the summer months now here, we enter into another cottage season – a time for family and friends to gather, make new memories and relax and unwind. For many, cottages hold significant sentimental value. They are a…

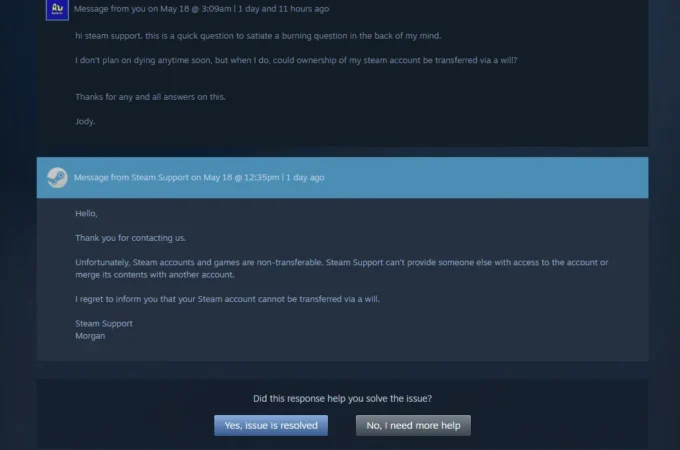

Pictured: A screenshot of a discussion between a Steam user and a Steam Support representative that has taken the internet by storm. Usually, I get my trusts and estates-related news from legal blogs, LinkedIn or emails from colleagues. So, you can imagine my surprise when I stumbled upon a pretty…

This blog has been written by Darren Lund, a partner at Fasken LLP In Ontario, trust law and family law have for some time taken very different approaches to valuing the interest of a beneficiary in a discretionary family trust. For trust lawyers, a beneficiary’s interest in a discretionary family…

An estate trustee is responsible for distributing the property of the deceased to those who are beneficially entitled to it (either in accordance with the terms of the relevant testamentary instrument or, where there is no such instrument, in accordance with the rules set out in the relevant legislation). What…

This Blog has been written by Darren Lund, Partner at Fasken LLP As we turn the page on 2023 and look ahead to 2024, the cost and availability of housing continues to be a pressing issue for many Canadians. While there have been some recent headlines that suggest the housing…

Trustees holding title to real property jointly with right of survivorship should make estate succession efficient and inexpensive. But recent changes implemented by the Director of Land Titles are challenging that notion.

This blog has been written by Darren Lund a partner at Fasken LLP. Marriage contracts and cohabitation agreements are an increasingly important aspect of estate planning and wealth preservation. They can be used for a number of reasons and in a variety of contexts. Think of the parents wishing to…

When a trust makes a capital distribution to a non-resident beneficiary, the beneficiary is deemed to have disposed of a part or the whole of their capital interest in the trust.[2] Where the capital interest in the trust is “taxable Canadian property” (“TCP”),[3] the vendor of the TCP (i.e. the beneficiary who is deemed to be “disposing” of their interest in the trust) must apply for a clearance certificate from the Canada Revenue Agency (the “CRA”) under section 116, either in advance of the disposition or within 10 days of the disposition.

It is important to consider estate planning objectives when entering into real estate transactions. For example, a client may intend to retain control of real property in that they intend to be able to dispose of it on death. However, if the relevant estate planning objectives are not identified and…