Trustees holding title to real property jointly with right of survivorship should make estate succession efficient and inexpensive. But recent changes implemented by the Director of Land Titles are challenging that notion.

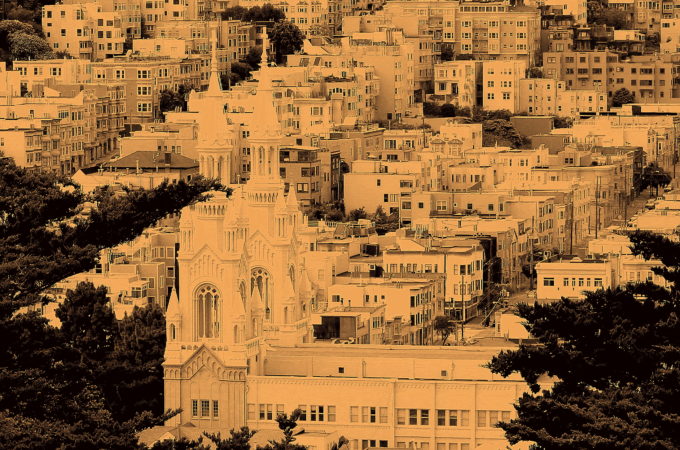

Category: Cottage

When a trust makes a capital distribution to a non-resident beneficiary, the beneficiary is deemed to have disposed of a part or the whole of their capital interest in the trust.[2] Where the capital interest in the trust is “taxable Canadian property” (“TCP”),[3] the vendor of the TCP (i.e. the beneficiary who is deemed to be “disposing” of their interest in the trust) must apply for a clearance certificate from the Canada Revenue Agency (the “CRA”) under section 116, either in advance of the disposition or within 10 days of the disposition.

This Blog was written by Natalie Melanson, Estate and Trust Advisor at MD Private Trust Company which is part of Scotia Wealth Management This long Canadian winter has finally come to an end and Canadians can look forward to some great spring and summer long weekends and vacations. With the summer season upon…

Can an estate claim a loss for tax purposes if the estate sells the property for less than what it was valued for at time of death? Hard to imagine such circumstances in this current real estate environment but in the unlikely event it does occur, what are the rules?…

Alter-ego and joint-spousal[1] trusts are inter-vivos trusts commonly used in estate plans to hold legal title of assets for the benefit of the individual and/or their spouse, prior to death, accomplishing some of the following benefits: avoiding probate, providing privacy, expediency of inheritance distribution, and minimization of legal challenge on…

This Blog was written by Natalie Melanson, Estate and Trust Advisor at MD Private Trust Company which is part of Scotia Wealth Management As we are now nearing the end of September, we know or hear of many people who are in the middle of closing up their vacation homes for the…

Both alter ego and joint partner trusts (the trust) allow a settlor to transfer capital assets into the trust on a tax-deferred basis if the following conditions are met: The trust is created after 1999. The settlor is at least 65 at the time of creation. In the case of…

The gratuitous transfer of property from a parent to an adult, capable child may result in a resulting trust.

Much has been written in this blog space and many others on this topic. Several times a year (in some years more often than others), we are asked in our practice about to advise on succession or estate planning issues for the family cottage. I was recently alerted to a…

In Luck v. Hudson, 2020 ONSC 3811 (Div. Ct.), the Divisional Court confirmed that an appeal is not the time to raise new issues and seek directions regarding an estate. In this case, the deceased and his wife owned a house together jointly which then sold (it is not clear…