In estate or guardianship litigation, disputes may arise in respect of contracts purportedly made by an individual before his or her death or by an attorney for property on behalf of the grantor. While it is trite that such agreements may be set aside on the basis of incapacity or…

Category: Contracts

Today’s blog was written by Jessica Butler, Law Clerk at Fasken LLP. Last weekend my husband and I settled in for a typical Sunday night at home – cozy on the couch with a good Netflix documentary. We decided to watch “Bob Ross: Happy Accidents, Betrayal and Greed”. What I…

This blog has been written by Darren Lund, partner at Fasken LLP Cross-border estate planning is undoubtedly a complex affair. When clients have assets in a foreign jurisdiction[1], are resident or have citizenship in a foreign jurisdiction, or wish to benefit individuals who are resident in a foreign jurisdiction, planners…

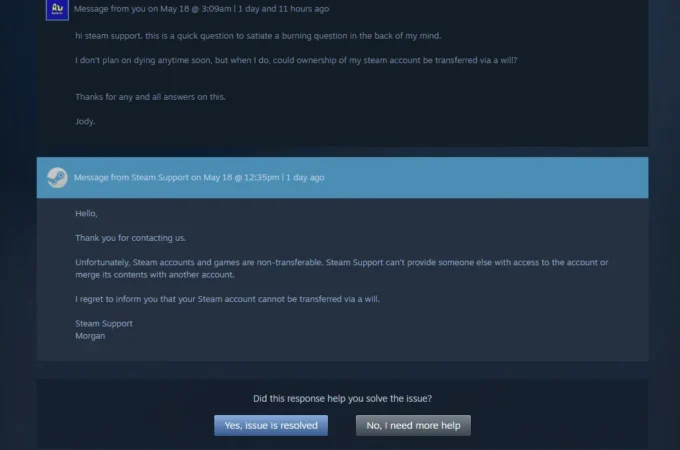

Pictured: A screenshot of a discussion between a Steam user and a Steam Support representative that has taken the internet by storm. Usually, I get my trusts and estates-related news from legal blogs, LinkedIn or emails from colleagues. So, you can imagine my surprise when I stumbled upon a pretty…

Generally, many of the estate litigation cases we see settle before the hearing of the application or before the matter proceeds to trial. However, quite often, minutes of settlement are not executed at the time an agreement is reached. Indeed, cases are sometimes resolved late in the evening or there…

Declaratory Relief Defined It is well understood that a court can order a party to do something or order a party to refrain from doing something. Another power of the court is its ability to make declarations. The Court of Appeal for Ontario defined a declaratory judgment in Bryton Capital…

With summer concerts, tours, and music festivals in full swing, I thought I would share estate planning considerations unique to music artists (the performing artists and songwriters, unless specified otherwise, the “artist”). I will use Taylor Swift as an example because the Taylor Swift/Scooter Braun controversy is helpful to my…

Families often fall into patterns and routines; they are comfortable, stable, and predictable. They can also give rise to legal rights over land. The extent and enforceability of those rights is often put to the test following death or divorce. Such was the case in Tomek v Zabukovec, 2020 ONSC…

These days, it is quite common to find intergenerational wealth transfer to consist of property held in a discretionary family trust whose beneficiaries may or may not have been in marital relationships at the time of the time the trusts were created. A siginifcant number of legal and financials issues…

Because the doctrine of suspicious circumstances was developed in respect of probate and wills, it cannot easily be exported into other areas of law, including contract law.