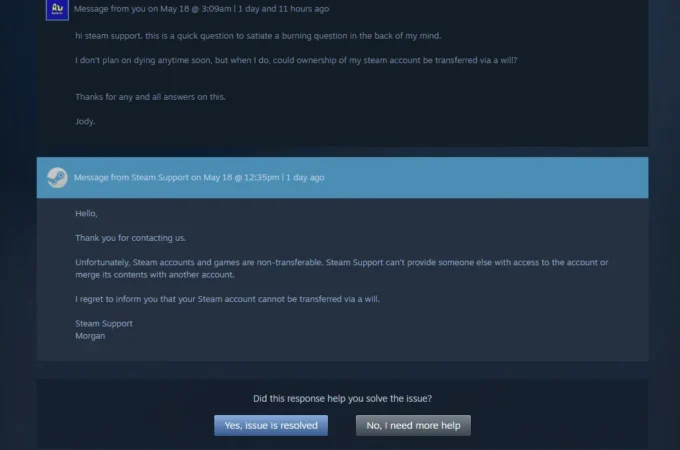

Pictured: A screenshot of a discussion between a Steam user and a Steam Support representative that has taken the internet by storm. Usually, I get my trusts and estates-related news from legal blogs, LinkedIn or emails from colleagues. So, you can imagine my surprise when I stumbled upon a pretty…

Tag: In the News

Today’s Blog was written by Jessica Butler, Law Clerk at Fasken LLP. Nicolas Puech (“Nicolas”), the 80 year old fifth-generation descendant of Thierry Hermès, founder of renowned fashion house, Hermès, made headlines in December when he announced that he plans to bequeath at least half of his fortune to his…

This blog was written by Courtney Lanthier, Law Clerk at Fasken LLP. We often hear in the news of beloved celebrities passing away after years of lucrative careers. It’s also common to speculate as to how their estate will be distributed. Many celebrities have either left, or plan to…

With summer concerts, tours, and music festivals in full swing, I thought I would share estate planning considerations unique to music artists (the performing artists and songwriters, unless specified otherwise, the “artist”). I will use Taylor Swift as an example because the Taylor Swift/Scooter Braun controversy is helpful to my…

Estates law doesn’t typically make the news, so my attention is always piqued when I see a headline about a Will. A recent criminal case featuring a fraudulent Will made front-page news, and serves as a reminder of what a powerful document a Will is, the need to carefully plan…

*There are 22 Ed Sheeran song references in this blog. How many can you find?* The key to winning any court case? Sing. You’ll make the judge swoon. If you are acting as the executor for the estate of an artist, intellectual property is likely your most valuable asset. Some…

Overview The Ontario government has enabled municipalities to enact a tax on vacant residential units in their regions (Granted under Part IX.1 of the Municipal Act).[1] Each municipality has to pass a By-Law stating the tax rate and conditions of vacancy that, if met, make a property subject to…

Today’s blog is co-written by Jennifer Campbell and Sandra Arsenault, Senior Law Clerks in the Private Client Services Group at Fasken. At the beginning of November, we were fortunate enough to attend the Institute of Law Clerks of Ontario (ILCO) annual conference in Niagara-on-the-Lake. This conference brings together law clerks…

Today’s blog has been written by Jessica J. Butler, Law Clerk at Fasken LLP Betty Marion White was born on January 17, 1922 and passed away at her home on December 31, 2021 – just 17 days shy of her 100th birthday. “I feel like crawling under the covers and eating…

For several years now, clients and contacts (with more frequency of late, and that’s no accident) have been asking me: “Hey Steve, I am turning 65 shortly, do I apply for CPP now or do I wait – what makes more sense financially” Based on analysis provided by experts in…