I recently went looking for information to assist wine and spirit collectors with their estate planning. To my surprise there is little material online. It’s easy to uncovered truth by drinking wine – “in vivo veritas” – but much harder to find a comprehensive Canadian resource about estate planning for collectors.

I recently went looking for information to assist wine and spirit collectors with their estate planning. To my surprise there is little material online. It’s easy to uncovered truth by drinking wine – “in vivo veritas” – but much harder to find a comprehensive Canadian resource about estate planning for collectors.

After meditating on this paucity over a bottle of Okanagan pinot noir that I found in my cellar (well, basement cupboard), I decided a blog was in order. Here are a few issues to consider:

1. Personal Property

Wine and spirits are personal property, but the tax treatment depends on the value and intent of the collection. There are three categories.

- Garden variety wine and spirits. If a few bottles left over at death, great, enjoy at a wake or funeral. The plonk is not worth planning for, nor including in an estate asset list. CRA has little interest.

- Collections with value under $1,000. Here the personal-use property rules apply. The adjusted cost base of the collection is assumed to be $1,000, hence no tax would be owing.

- Collections over $1,000 of fine quality wine or spirits would be considered listed personal property and capital gains tax would apply. Listed personal property is assumed to increase in value over time, and thus likely to be associated with higher quality bottles. The taxpayer must track cost base, which is often a challenge in an estate.

Consult with a qualified tax professional about valuable collections, as there is a lot more to the subject that can be addressed here.

2.Quaffable

Fine wine and spirits have value in the bottle, but they are consumables. The history of war is a chronicle of plundered wine cellars and wild bacchanalian parties. For executors unauthorized consumption can be a threat. Security should not be taken for granted.

3. Moveable

Easily transported, wine and spirits can sprout legs. Inventory and locks are essential precautions.

4. Spoilable

Wine spoils if heated, frozen or subject to excess humidity or dryness. A liability for executors is ensuring a fine wine collection is stored under ideal circumstances. Not all wines age well and inventory must be managed (i.e. consumed). Spirits, thankfully, are stable.

5. Semi-Illiquid

Wine and liquor is a controlled substance in Canada and may be subject to excise tax when transported across a border. A secondary market exists but is limited in scope. For example, the auction house Waddingtons has regular wine and spirit auctions. Various wine collector advisors , storage firms and dealers have sprung up, and there is a private trade if you go looking. One such firm is Iron Gate Wine.

6. Fakeable

Popular culture is filled with lurid stories of wine fraud. The ingredients? The wrong wine, the right bottle, and a good story told by a charming fraud artist. The documentary film Sour Grapes has become a classic of the genre. The books In Vivino Duplicitas and Billionaires Vinegar are great reads, but represent executor nightmares.

7. Donatable

There are a number of Canadian charities that accept donations of wine for fundraising auctions. Tax receipts are issued for fair market value. This provides an outlet for executors and beneficiaries to unload stock, help charities, and pick up good bottles at decent prices. Donations tend to be one-offs, not planned estate donations.

8. Tweetable

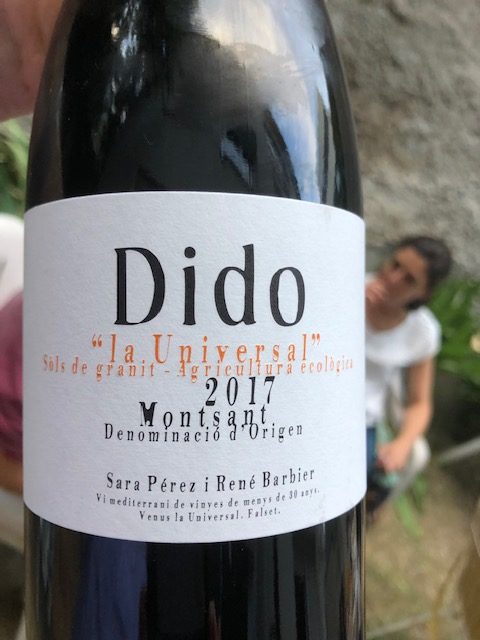

Finally, there is wine social media. Check out the app Vivino. It’s ideal for anyone who has a hard time remembering what they drank last week and also for those who wish to connect with a knowledgeable worldwide community of winos.

11 Comments

Sara Kinnear

September 12, 2019 - 1:26 pmI don’t think a collection of wine would meet the definition of listed personal property under section 54 of the Income Tax Act. That definition is restricted to the listed items, being art, jewellery, books, stamps, and coins.

Malcolm Burrows

September 12, 2019 - 2:51 pmHi Sara –

Thanks for your comment. I’ll go back and have a look about restrictions in s 54 and talk further with tax colleagues. The guidance I have received from tax professionals is s54 is not limited to named property, and so includes wine and spirits. If not listed personal property then what would it be? I ask with genuine curiosity. Other readers are is encouraged to shared their collective knowledge. Malcolm

Ryan Fraser

September 12, 2019 - 2:06 pmWould the capital gains as LPP be calculated be on the collection as an entity or per bottle?

Malcolm Burrows

September 12, 2019 - 2:46 pmHi Ryan – Thanks for your comment. I think it would depend on the collection and the bottles it contains. And for this I would need to defer to a valuator. I will consult and report back. Malcolm

Patricia Chartrand

September 12, 2019 - 4:07 pmAs the government controls the private sale of alcohol, makes for limited avenues in which to sell the assets.

Malcolm Burrows

September 12, 2019 - 4:53 pmThx Patricia. Thanks for highlighting the regulatory piece further. This is an issue to navigate. Malcolm

Peggy Killeen

September 12, 2019 - 11:51 pmI have no legal commentary to make, I just love the subject and your treatment of it. You’re living proof of these wise words from Ralph Waldo Emerson: “A man will be eloquent if you give him good wine.” Santé!

Janet Kim

September 13, 2019 - 7:20 pmThanks Malcolm – your post is not only a model of edutainment, but very timely, as a colleague is in the midst of discussions with a donor about a potential gift of valuable collectibles. I hope for, and anticipate eagerly, your update if/as you clarify some of the issues raised by commenters. Thank you as always for your contribution to our collective knowledge.

Malcolm Burrows

September 13, 2019 - 8:55 pmHi Janet – Thanks for your kind comments. Collectibles generally are listed personal property. Here’s a quick CRA summary. https://www.canada.ca/en/revenue-agency/services/tax/individuals/topics/about-your-tax-return/tax-return/completing-a-tax-return/personal-income/line-127-capital-gains/completing-schedule-3/listed-personal-property.html Capital gains taxes apply, unless the collection is eligible to be cultural property (assuming the gift is to the university). A great gift if the mission fit is there; if the collection is to be sold, get the executor to do it! Malcolm

Jamie Golombek

July 17, 2023 - 6:34 pmI have revisited this blog from 2019 in light of a webinar I’m giving soon on Wine Collecting – tax and estate planning considerations. It seems that wine is not listed personal property for the simple reason that it’s not listed. It would still be personal use property such that gains would be taxable, keeping in mind the $1,000 rule. The key question is whether that $1,000 applies per bottle? Or for the collection!

Malcolm Burrows

July 17, 2023 - 6:44 pmJamie – Thanks for digging up this blog and for your further insights. Upon reflection, I agree with assessment that wine would be personal property. I think you could argue the $1000 valuation rule threshold either way: by the bottle or for the collection. For a serious collection, it would be hard to argue for by the bottle – and some overall valuation would be required partly due to numerous $1000+ bottles. A garden variety collection could limbo under the per-bottle threshold without contest… Malcolm