You’ve already beaten the odds — now make sure your fortune doesn’t roll the dice without you. Over the years, I’ve had the privilege of helping lottery winners turn sudden wealth into lasting legacies. Here are six key considerations to keep in mind from an estate planning perspective: Assemble…

Tag: succession

One of the most interesting and challenging aspects of working in the trusts and estates field is how different the rules can be, not just internationally, but within our national borders. For example, this week I was chatting with my Quebec colleagues about Bill 56 – An Act respecting family…

Nearly two years ago, I wrote a blog post titled “Assessing Drake’s Estate Planning Needs”. The post looked at rap sensation Drake’s assets vis-à-vis his intent for his son Adonis to be the sole beneficiary of his estate, and the various considerations that he ought to have in planning for…

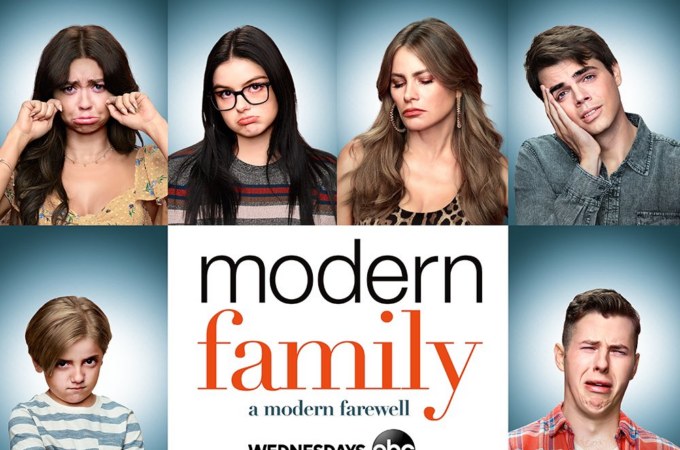

Last week, my colleague Yvonne Mazurak wrote a blog post about a recently-released television show, And Just Like That, discussing the estate planning issues highlighted by the events of the show. So, I thought I would provide a bit of a television recommendation show of my own…although my taste is…

The internationally acclaimed television series Downton Abbey introduced many people to Britain’s past inheritance laws. The practice of primogeniture is no longer British law but still remains an inheritance model for Britain’s major landowning families. A new survey conducted for Country Life last week, shows an emerging change in succession attitudes to relax the enforcement of the primogeniture model to transfer land and title. Only 16% of the major landowning families surveyed strictly implement the practice of primogeniture.