Like so many other things, continuing care and living costs are on the rise. Whether you are a Henson Trust Trustee or a Discretionary Inheritance Trust Trustee, the onus to prudently manage investments is more crucial than ever. It is also imperative that investment plans fit the circumstances of the beneficiary in order to maximize investment value.

That being the case, a Trustee for a Henson Trust is called upon to be so much more than just a basic Executor of an Estate and simple Trustee. Where there is a beneficiary with a disability, a Henson Trust Trustees is relied upon to invest and manage assets to generally allow the Trust to last for the duration of the life of the beneficiary without prejudicing entitlements to provincial support. Consideration must be given to inflation, the market, and risk paired with the individual short and long-term needs of the beneficiaries.

To better understand what is involved in this type of planning, from an investment management perspective but also from the point of view of a parent of a child with a disability, I spoke with my colleague Matt Horan. Matt, a Senior Wealth Advisor and Portfolio Manager at Scotia McLeod, is a proud parent of a son living with Autism. Matt was good enough to put into his own words what his thoughts and feelings are on the key role a Trustee plays in providing families peace of mind that their loved ones will be cared for long after the parents are able to oversee it:

“As a parent of a child with low-functioning Autism, I am very aware of the additional stresses this type of family dynamic can create. Not only do families have elevated costs as they raise and continue to support their child in adulthood, parents also have to consider the financial supports in place when they are gone or incapable. Realistically, this could mean a 30+ year financial commitment.

Ultimately, parents want to know ‘will the money earmarked for ensuring my son/daughter will be in a good facility and well cared for when I am gone be enough?’ The more vulnerable the child, the more anxiety! A prudently managed Henson Trust is a terrific vehicle to help achieve this financial security, ease the anxiety and potentially reduce taxes to minimal level.

First, addressing the math of the situation is crucial. 30 years can see a lot of change in the economy, in the cost of care and many other factors. I am not suggesting that a parent can solve everything from the grave, but a well-structured investment plan within Henson Trust gives a family a great start.

Having given countless hours of thought to this subject myself (often at 3 am), here is what I would do with limited resources.

Currently, the care required for a dependent low-functioning person with autism can easily reach or exceed $95,000 per year. This is because it is not just about room and board, but the need for a continuous high-level of care and various specialized programs.

With this potential high drawdown rate, it is vital to have a Trust with a rising income stream to keep up with the increasing living costs. I would look to a portfolio with an increasing income stream. Keeping that the top of mind, I would look to invest in a conservative dividend growth portfolio; realistically dividends would grow at approximately 6% per year, with the dividend cash flow supported by a bond ladder of maturities for the first 20+ years.

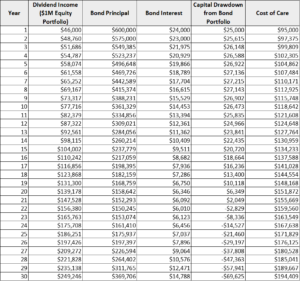

The below mathematical exercise illustrates a $1.6 million portfolio assuming a cost of care increase at 2.5% per year, not considering provincial support and assuming that funds are exempt from income and paid out for approved disability-related items. You will see that income comes from dividends and bond interest, with the shortfall being made up from the bonds’ capital. This allows the portfolio and the dividends to grow to a point where income can eventually cover total cost of care needs.

While everyone’s situation is unique and comes with different stressors, connecting the investment plan with the care plan costs can help reduce some of those 3 am situations where the only thing on your mind is how my child will be after I am gone.

I know not everyone will have a large estate to fund a Trust. If I had limited resources, an alternate source I would investigate (in addition to a Registered Disability Plan) is an insurance policy to help fund a trust. For example, a $1 million Term-100 policy for a couple aged 45 and in good health, would cost approximately $632 monthly.

At the end of the day, those of us who have adult dependent children need to develop a plan now to secure the long-term financial and physical well-being of our loved ones. It pays to do the homework sooner rather than later to save the sleepless nights in the future.”

About the Authors and Authors’ Disclaimer

Matt Horan & Michael Chisholm are Senior Wealth Advisor with Scotia McLeod. The Horan Team was recently ranked 11th nationally in the Report on Business Magazine Mail 2022 Shook for Canada’s Top Wealth Advisor.

Holly LeValliant is an Estate and Trust Consultant in Toronto with Scotia Wealth Management. With a background as an estate litigation lawyer, Holly approaches her files with the lens of preventing problems with estate plans before they happen.

As every situation is different, we offer this article for information purposes only, and not as advice (tax or otherwise).

0 Comments