One the biggest trends in philanthropy of the last thirty-years is the rise of donor-directed or restricted giving. Donors want more control, which typically results in more restrictions being placed on gifts. But there are risks of placing restrictions on a charitable gift by will.

One the biggest trends in philanthropy of the last thirty-years is the rise of donor-directed or restricted giving. Donors want more control, which typically results in more restrictions being placed on gifts. But there are risks of placing restrictions on a charitable gift by will.

Failure and Cy Pres

Simply, a restricted gift will fail if the charity is unable to honour the restriction. In Canada, the recourse is to involve the provincial Public Guardian and Trustee and make a cy-pres application to court, but this route is expensive and may lead to unforeseen results. For example, the court may uphold the charitable purpose but not the named charity.

In Ontario, Section 13 of the Charities Accounting Act provides a simplified process to vary purpose, but the law is biased to support donor intent. (As Prof. Kathryn Chan writes there is an underlying tension in law between the private trusts v. the public benefit of charity.) The Act also has a complaint mechanism for the misuse of charitable property.

Planning Solutions

When planning an estate donation, the best practice is to consult the charity in advance about the proposed restrictions. Even this isn’t a fool-proof solution, however. A charity may, with good intentions, accept restrictions that it is unable to uphold in the future. Or a charity may feel obligated — due to eagerness to please the donor or pragmatism in securing the gift — to accept the proposed restrictions against its better judgement.

The other option is to structure the gift by will to ensure it receives tax relief, but to leave discretion about the final beneficiary to the executor. This can be done by providing the executor discretion to choose the beneficiary, but not make the gift. Alternately, a public foundation with donor advised fund may be used if there is the ability to make a payout of capital within a year or two of death.

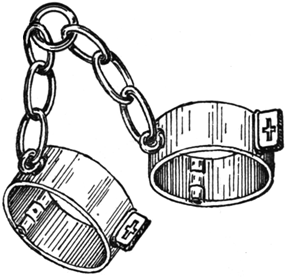

Dead Hand

As a general rule, the more restrictions the greater the likelihood an estate donation will fail. This is especially true if the donor is trying to go beyond the charity’s core programs and mission. Charity law identified this tendency early on with the concept of “mortmain” or the “dead hand” of the donor ruling the living. The community foundation movement started in Cleveland in 1914 as an institutional way to address the problem of outmoded charitable trusts.

Trust

Make no mistake, charities prefer gifts with no restrictions, both during life and at death. As the trust-based philanthropy movement has made clear, high impact charities have and need general funds. Charities know the need and should be trusted to do their work without handcuffs or second guessing.

0 Comments