To paraphrase the common law, a gift must be “freely given without consideration”. “Consideration” means without expectation of benefit, which eliminates contractual or other binding rights. This concept was addressed by my colleague Darren Lund in a recent All About Estates blog on charitable donations from alter ego and spousal trusts.

Tax Credit or Certainty?

The issue: how can a testamentary spousal trust or an alter ego trust be drafted to enable a residual gift to charity be eligible for a tax receipt? This question was addressed by Canada Revenue Agency (CRA) at a recent STEP Canada session. The answer provided was consistent with CRA’s position for the last 30+ years. Still there was ripple of surprise in the estate planning community.

CRA’s long-standing view is that if a charity is named as a residual beneficiary of a trust, and there is power to encroach on trust capital, then the amount that the charity gets is not a gift. Instead it’s a distribution from the trust to a named beneficiary. The distribution is an obligatory transfer by the trustee, not a freely-given donation.

Conversely, for a trust to be eligible for a charitable tax receipt the trustee must have discretion to make the gift, freely. The settlor can provide a side letter to the trustee with preferred charities. Even so it’s unsatisfying to settlors, especially of testamentary trusts. The suggested gift is not binding. The trustee must do the “right thing”, although that gets complicated if she lacks charitable intent or there are litigious family members waiting to pounce.

A drafting idea

One drafting idea to increase the certainty of a tax-effective gift is to both name a charity as a residual beneficiary and provide the trustee with power to make a donation. Why both? That way the charity will get the property. The settlor doesn’t have to choose between certainty and tax efficiency; and the trustee doesn’t have to risk making a charitable donation. With careful drafting, I bet the trustee can choose to override the residual beneficiary designation with a tax-effective gift. It may inspire better planning.

A reform idea

When I suffer from tax-policy-induced insomnia, I fantasize about replacing trustee discretionary gifts with a more rational trust structure. I’m inspired by the 2016 “estate donation” rules.

Under this regime, a charitable gift by will is now a gift from a trust, the estate. This gift is stipulated by the deceased settlor, unlike the spousal trust rules. A tax receipt may be issued by the charity to the estate. Pre-2016, a gift by will was deemed to be a lifetime gift of the deceased. The new regime avoids the “trustee with charitable discretion” conundrum.

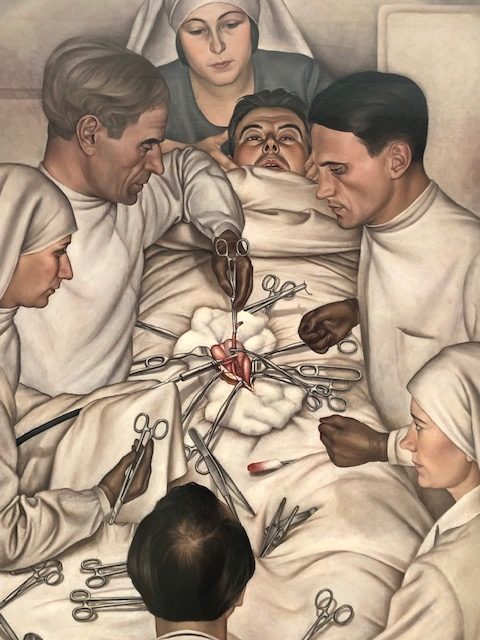

The estate donation rules enable what the trustee discretionary donation rules deny. Maybe we need to ask CRA to step aside so Finance can change the Income Tax Act to make the charitable spousal trusts simpler and more dependable. Let’s get to the heart of the matter.

0 Comments