This blog has been written by Darren Lund, a partner at Fasken LLP In Ontario, trust law and family law have for some time taken very different approaches to valuing the interest of a beneficiary in a discretionary family trust. For trust lawyers, a beneficiary’s interest in a discretionary family…

Category: Property

An estate trustee is responsible for distributing the property of the deceased to those who are beneficially entitled to it (either in accordance with the terms of the relevant testamentary instrument or, where there is no such instrument, in accordance with the rules set out in the relevant legislation). What…

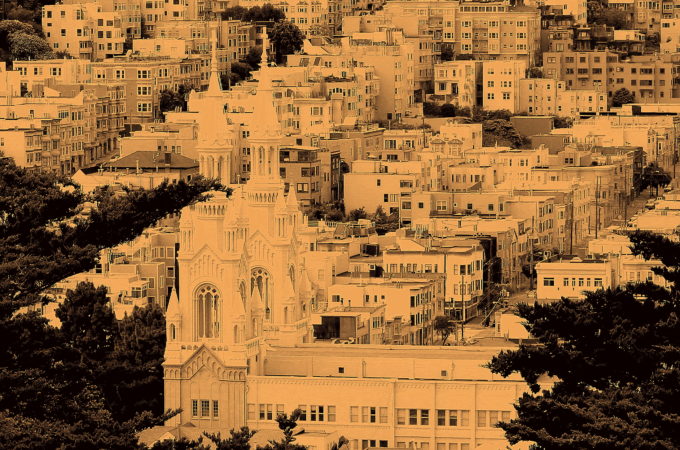

This Blog has been written by Darren Lund, Partner at Fasken LLP As we turn the page on 2023 and look ahead to 2024, the cost and availability of housing continues to be a pressing issue for many Canadians. While there have been some recent headlines that suggest the housing…

Trustees holding title to real property jointly with right of survivorship should make estate succession efficient and inexpensive. But recent changes implemented by the Director of Land Titles are challenging that notion.

This blog has been written by Darren Lund a partner at Fasken LLP. Marriage contracts and cohabitation agreements are an increasingly important aspect of estate planning and wealth preservation. They can be used for a number of reasons and in a variety of contexts. Think of the parents wishing to…

When a trust makes a capital distribution to a non-resident beneficiary, the beneficiary is deemed to have disposed of a part or the whole of their capital interest in the trust.[2] Where the capital interest in the trust is “taxable Canadian property” (“TCP”),[3] the vendor of the TCP (i.e. the beneficiary who is deemed to be “disposing” of their interest in the trust) must apply for a clearance certificate from the Canada Revenue Agency (the “CRA”) under section 116, either in advance of the disposition or within 10 days of the disposition.

It is important to consider estate planning objectives when entering into real estate transactions. For example, a client may intend to retain control of real property in that they intend to be able to dispose of it on death. However, if the relevant estate planning objectives are not identified and…

In the ever-evolving landscape of Canadian law, the donation of genetic material presents a complex and multifaceted challenge both in the case of inter vivos donations and posthumous ones. The intersection of property rights, consent, and privacy in this context is not only legally intricate but also laden with ethical…

Families often fall into patterns and routines; they are comfortable, stable, and predictable. They can also give rise to legal rights over land. The extent and enforceability of those rights is often put to the test following death or divorce. Such was the case in Tomek v Zabukovec, 2020 ONSC…

Today’s blog is written by Jessica J. Butler, Law Clerk at Fasken LLP. The world of wills and estates is a complex one, and it can be easy to lose sight of the bigger picture. A refresh of keystone practice elements can help remind us to see the forest through…